Where’s the exit here?

Every time a VC investor makes a move, we can bet he did some estimates of his future exit — whom to sell and at what price (calculating chances he makes a good IRR for his LPs and brings home some juicy bonuses). Although the expected exit valuation is one of the two most important determinants of the entry valuation (the desired ROI being the second), the underlying reasoning is often a black box for founders. So let’s shed some light on how the valuation depends on investors’ exit strategy.

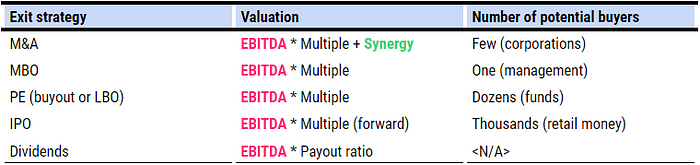

First, what’s the typical exit path for a VC investor after he got into the “game-changing disruptive private technology company”? Look:

While it’s simple with dividends, it gets a little more complicated with the buyers. Traditionally, they fall into two broad categories — strategic (those who don’t plan to resell) and financial (those who do). The fundamental difference between the two is that the strategic will eventually pump out dividends, and the financial will mainly benefit from capital gains for a resell. Now, how do these different groups price their investments at entry?

So we see that the entry valuation task can be reduced to two things: a) guessing the company’s future EBITDA (whether it’s a hot AI startup or a mattress manufacturer — it doesn’t matter), and b) assigning a multiple to it. No future EBITDA almost surely means no value, or it can even be negative, so the founders would pay the investors for investing to make the opportunity attractive. For those of you who ask, “What about OpenAI?” — think of them as belonging within the “synergy” bracket (or have you started noticing the ChatGPT ad in your Microsoft account?). We covered this case in one of our previous notes — Free Cash Flow to Acquirer (FCFA).

So the EBITDA-generating companies have literally 5X (five ways out vs. only one, sell for synergy) higher liquidity and, therefore, probability of being exited. That’s why at Lemma, we seek founders who clearly stick to long-run profitability with their growth strategy. And if we don’t sell, we’d be happy with a perpetual dividend flow instead 😎